Adverse Selection

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

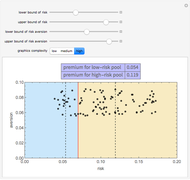

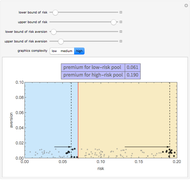

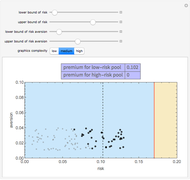

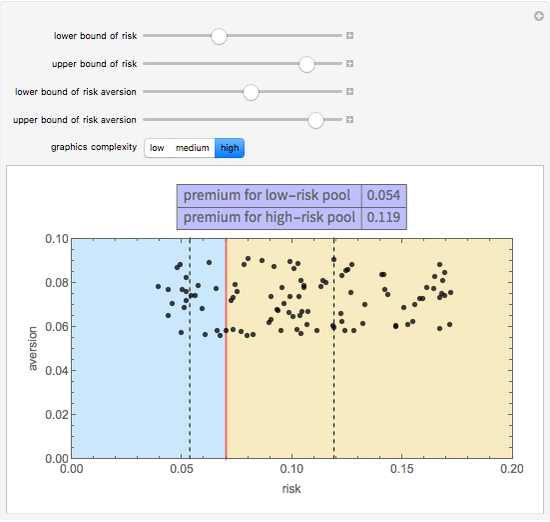

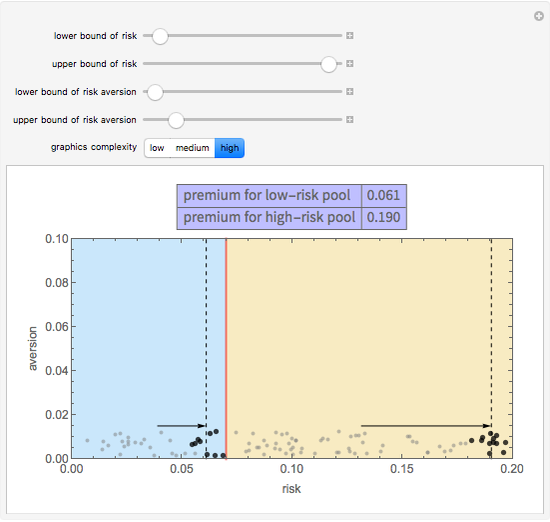

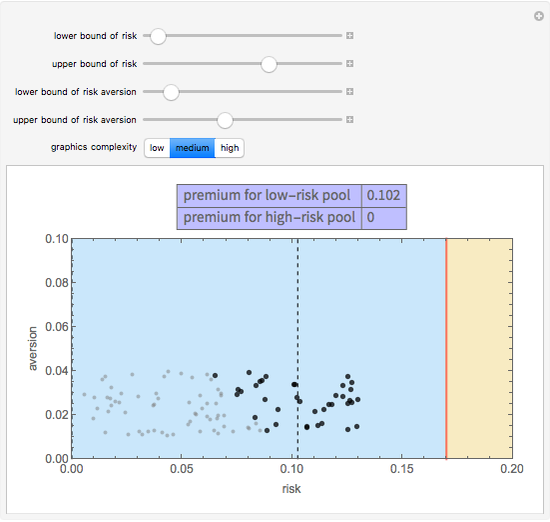

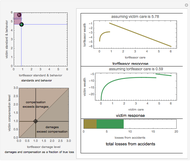

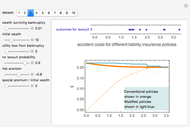

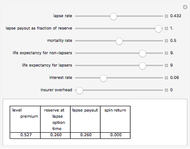

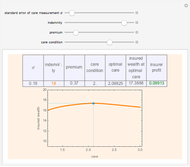

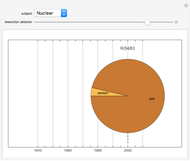

Adverse selection is the proclivity of those with higher risk to purchase insurance in greater amounts than those with lower risk. Much of insurance law and practice is designed to control adverse selection. This simulates how the distribution of risk versus risk aversion levels among the members of the pool interacts with the classification criterion used by the insurer to produce different levels of adverse selection. You can adjust the characteristics of the pool using the sliders and adjust the criterion used to separate the pool into "low-risk" (blue) and "high-risk" (yellow) by dragging the red line to the left or right. Darker and larger points show insureds who purchase insurance; lighter and smaller points show potential insureds who decline to purchase insurance. With the graphics complexity control set to medium or higher, dashed lines show the equilibrium premiums for insurance. With the graphics complexity control set to high, arrows show the increase in premium prices due to adverse selection.

Contributed by: Seth J. Chandler (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

Snapshot 1: with high levels of risk aversion in the potential insurance pool, adverse selection is not a serious problem

Snapshot 2: with low levels of risk aversion in a pool that is heterogeneous with respect to risk, adverse selection can be a serious problem, even with binary classification systems

Snapshot 3: the locator dividing the low-risk pool from the high-risk pool has been moved so that everyone is now in the low-risk pool; the result is high levels of adverse selection

Snapshot 4: the creation of a classification system decreases adverse selection by permitting a number of low-risk insureds to purchase insurance; premiums for those in the high-risk pool are, however, slightly higher than they would have been if no classification system had been employed

Risk aversion is not measured in this Demonstration using Arrow–Pratt coefficients. Rather, for simplicity and to accelerate computation of optimal behavior, risk aversion  is equal to the value such that the insured will purchase insurance if and only if

is equal to the value such that the insured will purchase insurance if and only if  .

.

Permanent Citation

"Adverse Selection"

http://demonstrations.wolfram.com/AdverseSelection/

Wolfram Demonstrations Project

Published: March 7 2011