Employer Health Insurance Choices under H.R.3590 and H.R.3962

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

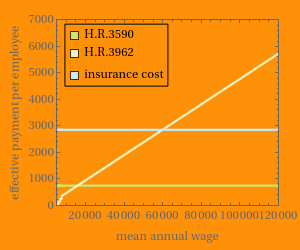

Healthcare reform bills pending in the United States Congress in 2009 generally force employers either to provide health insurance for their employees or pay the government to subsidize the healthcare those employees are nonetheless expected to receive. This Demonstration puts you in the role of an employer and shows the financial consequences of providing health insurance or declining to do so in 2014 and beyond. It does so under the two leading reform contenders: H.R.3590, the Patient Protection and Affordable Care Act (Senate), and H.R.3962, the Affordable Health Care for America Act (House of Representatives). Basically, H.R.3590 requires many employers not providing compliant health insurance to pay an assessment of $750 per employee. H.R.3962 imposes a payroll tax from 2% to 8% on many noncomplying employees.

[more]

Contributed by: Seth J. Chandler (March 2011)

Additional contributions by: Ira Shepard

Open content licensed under CC BY-NC-SA

Snapshots

Details

The model developed here does not consider the proposed addition of section 45R to the Internal Revenue Code that would provide a tax credit to certain small employers for purchasing health insurance on behalf of their employees through one of the "Exchanges" established by the reform bills.

Precisely modeling the indirect costs occasioned when an employer declines to provide health coverage to its employees is difficult. This model assumes that such costs are a user-selectable coefficient multiplied by the difference between the total average premiums the employer would have paid for coverage and any "bonus" the employer chooses to provide the employee after dropping coverage.

The provisions underlying this Demonstration may be found in section 1513 of H.R.3590 and section 512 of H.R.3962.

Although there are many exceptions, health insurance in the United States frequently comes in two "flavors": individual coverage provides health insurance only for the purchaser; family coverage provides health insurance for the purchaser and for certain members of the purchaser's immediate family.

Snapshot 1: the Demonstration in its default settings; these numbers are intended to typify values likely to face employers

Snapshot 2: the Demonstration in its default settings, except that the number of employees has dropped to 16

Snapshot 3: the Demonstration in its default settings, except that the proportion of employees electing coverage is assumed to drop to 0.4

Snapshot 4: the Demonstration in its default settings, except that the premiums for individual and family coverage have declined

Snapshot 5: the Demonstration in its default settings, except that the indirect costs of dropping coverage have increased; notice that the employer now does better to purchase insurance under H.R.3590 but still does better under H.R.3962 to drop insurance and pay the payroll tax instead

Snapshot 6: the Demonstration in its default settings, except that the "no coverage" wage bonus under H.R.3590 has increased to $3200; the employer does better dropping coverage and paying the employees $3200 each rather than keep providing health insurance

Permanent Citation

"Employer Health Insurance Choices under H.R.3590 and H.R.3962"

http://demonstrations.wolfram.com/EmployerHealthInsuranceChoicesUnderHR3590AndHR3962/

Wolfram Demonstrations Project

Published: March 7 2011