Generalized Hyperbolic Distribution

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

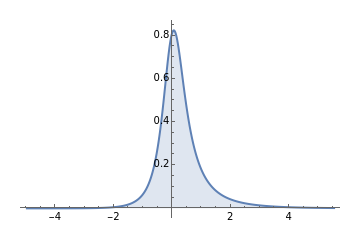

This Demonstration shows the probability density function of the generalized hyperbolic distribution, which generalizes a large number of distributions with numerous applications in finance and other areas. There are a number of parametrizations of this distribution. We use the most common one with five parameters, of which  and

and  describe the location and the scale, while

describe the location and the scale, while  and

and  determine the shape of the distribution. Special values of the parameter

determine the shape of the distribution. Special values of the parameter  often correspond to well-known special cases: for example,

often correspond to well-known special cases: for example,  gives the hyperbolic distribution and

gives the hyperbolic distribution and  gives the normal inverse Gaussian (NIG) distribution. On the other hand, the case

gives the normal inverse Gaussian (NIG) distribution. On the other hand, the case  gives the variance gamma distribution. Many other distributions are obtained as limiting cases.

gives the variance gamma distribution. Many other distributions are obtained as limiting cases.

Contributed by: Andrzej Kozlowski (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

Generalized hyperbolic distributions were introduced by Barndorff–Nielsen [1]. They generalize many previously known distributions in addition to being a source of many new ones. As they are infinitely divisible, Lévy and other stochastic processes can be based on them.

Such processes were first applied in finance by Eberlein and Keller [2]. Being normal variance-mean mixtures, GH distributions possess semi-heavy tails and allow for a natural definition of volatility models by replacing the mixing generalized the inverse Gaussian (GIG) distribution by appropriate volatility processes.

[1] O. E. Barndorff-Nielsen, "Exponentially Decreasing Distributions for the Logarithm of Particle Size," Proceedings of the Royal Society London A, 353(1674), 1977 pp. 401–419.

[2] E. Eberlein and U. Keller, "Hyperbolic Distributions in Finance," Bernoulli 1(3), 1995 pp. 281–299.

Permanent Citation