The Hazards of Propping Up: Bubbles and Chaos

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

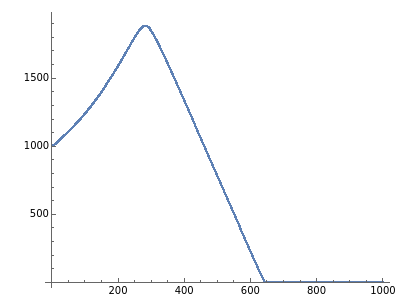

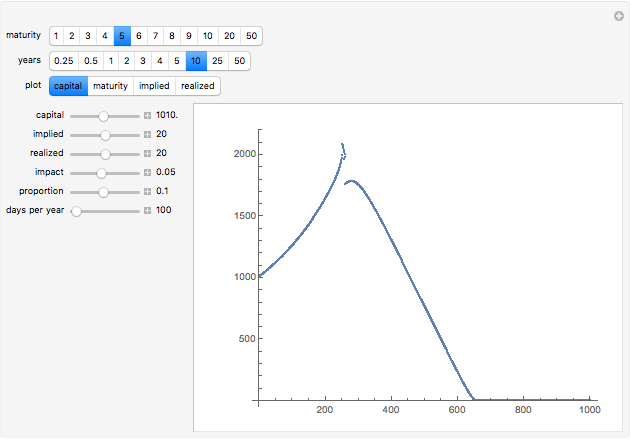

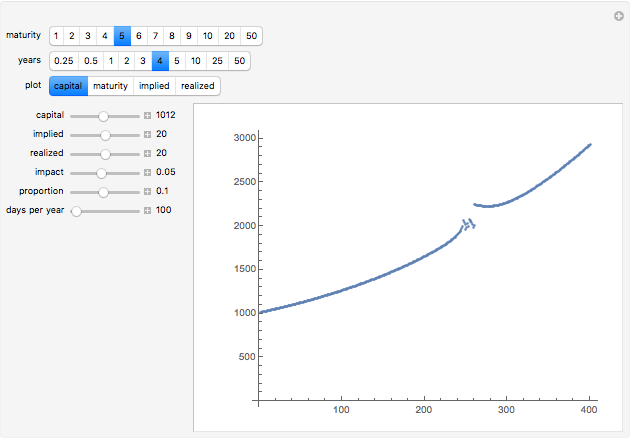

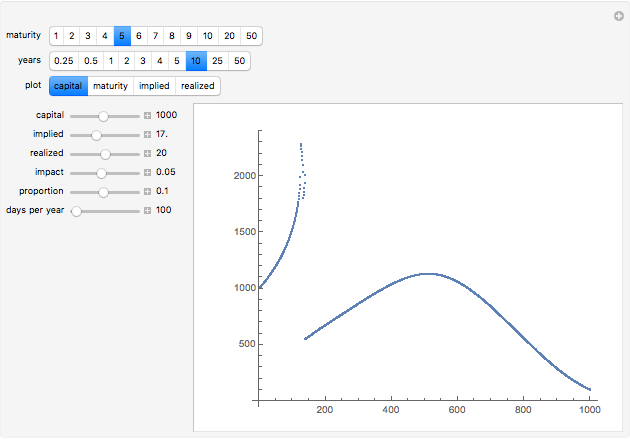

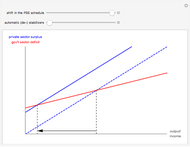

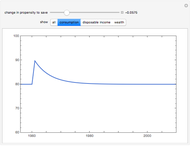

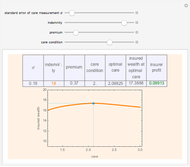

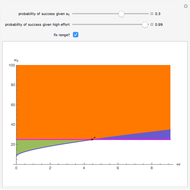

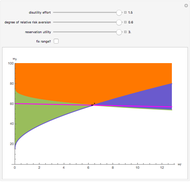

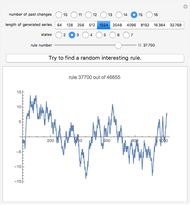

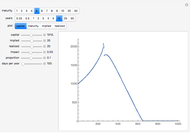

This Demonstration shows the potentially hazardous long-term effects of propping up. An entity with the given capital seeks to maintain a constant proportion exposure to a financial instrument that trades with a fixed maturity. As time goes by, the entity experiences profits from the difference between the realized value of the instrument and the implied price at which it purchased it. The instrument is relatively illiquid, so each purchase or sale by the entity has an impact on the implied price. The plot of the evolution of the capital, the average maturity of the held instruments, the implied price, or the realized value is shown for the given number of years, assuming time steps of 1/days per year. The evolution is often a smooth bubble but when the capital reaches a critical value, discontinuities can result.

Contributed by: Philip Maymin (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

In the current environment of financial distress, many governments are likely to soon become major holders of financial assets, but the debate focuses only on short-term market stabilization. This Demonstration shows that government intervention and propping up are likely to lead to bubbles and possibly chaos. The critical value of capital that generates discontinuities is the reciprocal of the product of the proportion squared and the impact. Further details on the model can be found at http://papers.ssrn.com/abstract=1282711.

Permanent Citation

"The Hazards of Propping Up: Bubbles and Chaos"

http://demonstrations.wolfram.com/TheHazardsOfProppingUpBubblesAndChaos/

Wolfram Demonstrations Project

Published: March 7 2011