The Method of Common Random Numbers: An Example

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

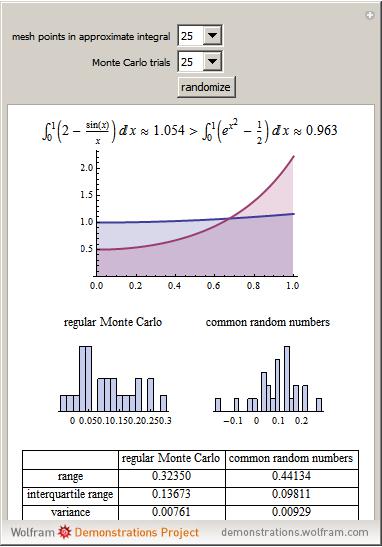

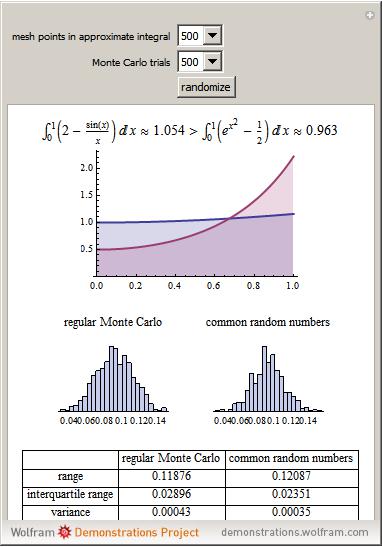

Variance reduction is of great interest to the creators of Monte Carlo experiments. For example, investment banks use very complicated Monte Carlo simulations to price esoteric mortgage-backed securities. These simulations often run overnight because many Monte Carlo trials are necessary to obtain (by the central limit theorem) a point estimate of some true population parameter, bounded by a relatively small confidence interval. One way to reduce the number of required Monte Carlo trials is to use a variance reduction technique.

[more]

Contributed by: Jeff Hamrick (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

This method of common numbers produces good, but not overwhelming, variance reduction. The method of common random numbers (also known as the method of correlated sampling, the method of matched pairs, or the method of matched sampling) does not always work. It can backfire if the the engineer of the Monte Carlo simulation creates a negative, rather than positive, correlation between the two random variables  and

and  . Often, it is useful to choose

. Often, it is useful to choose  , which we do in this example.

, which we do in this example.

Why does this method work?

Recall that, for example,  is a sequence of independent, identically distributed random variables. The variance of the first Monte Carlo method, when

is a sequence of independent, identically distributed random variables. The variance of the first Monte Carlo method, when  is independent of

is independent of  , is

, is

.

.

Now consider the second Monte Carlo method, the method of common random numbers. The variance of this Monte Carlo method, when  is positively correlated to

is positively correlated to  , is

, is

and therefore

.

.

If we make the additional assumption that  and

and  are either: (a) both monotonically nondecreasing; or (b) both monotonically nonincreasing, then

are either: (a) both monotonically nondecreasing; or (b) both monotonically nonincreasing, then

,

,

and we see that  .

.

Notice that in both cases,  and

and  have the identical marginals—the method of common numbers only permits us to manipulate the joint distribution of

have the identical marginals—the method of common numbers only permits us to manipulate the joint distribution of  and

and  . Also, notice that in our example, both

. Also, notice that in our example, both  and

and  are strictly monotonically increasing.

are strictly monotonically increasing.

In this particular example, the variance reduction is always successful. However, notice that other measures of dispersion—like the range or the interquartile range—are not always reduced by the technique.

There are more powerful variance reduction techniques available, including antithetic variates, control variates, importance sampling, and stratified sampling. For more information on the method of common random numbers, see Sheldon Ross's textbook Stochastic Processes or Paul Glasserman's book on Monte Carlo methods.

Permanent Citation