The Poisson Process

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

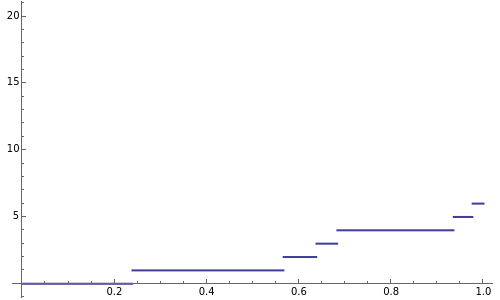

This Demonstration shows sample trajectories of a Poisson process—a fundamental example of a stochastic process with discontinuous trajectories, which is used as a building block for constructing jump processes that play an important role in modern financial modeling. You can vary the intensity of the jumps, the duration, whether the trajectories should be connected, and whether an ordinary Poisson process or a "compensated" one should be displayed.

Contributed by: Andrzej Kozlowski (March 2011)

Open content licensed under CC BY-NC-SA

Snapshots

Details

The Poisson process is one of the two most fundamental stochastic processes in continuous time financial modelling, the other being Brownian motion, with which it shares a number of common properties (both are examples of a Levy process). In this Demonstration two kinds of Poisson processes are shown: an ordinary one and one that is "compensated". The compensated Poisson process is a martingale with expected value 0. As the intensity of jumps increases, the compensated Poisson process approximates a Brownian motion (this follows from the Donsker invariance principle). Making the plot joined and choosing a high value for the intensity makes the trajectories resemble those in standard simulations of Brownian motion.

R. Cont, P. Tankov, Financial Modelling with Jump Processes, Boca Raton, London, New York, Washington, D.C: Chapman & Hall, 2004.

Permanent Citation

"The Poisson Process"

http://demonstrations.wolfram.com/ThePoissonProcess/

Wolfram Demonstrations Project

Published: March 7 2011