Value Added Growth Model

Requires a Wolfram Notebook System

Interact on desktop, mobile and cloud with the free Wolfram Player or other Wolfram Language products.

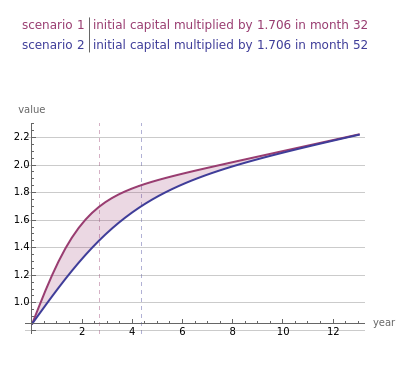

Real estate investors commonly look for mispriced properties. Often such properties, aka "fixer-uppers" in the field, are under-managed or mismanaged. Finding such a property represents a "turnaround opportunity" wherein the owner can add entrepreneurial value. The outcome, if successful, produces a growth curve that is initially steep during the early years of the turnaround process, followed by a "normal" period of income growth due to lease escalations, inflation, etc.

[more]

Contributed by: Roger J. Brown (March 2011)

Reproduced by permission of Academic Press from Private Real Estate Investment ©2005

Open content licensed under CC BY-NC-SA

Snapshots

Details

When the acceleration factor is zero the equation is linear and there is no difference in the scenarios. At some acceleration rates the two lines do not converge within the support of the plot. This may be safely ignored, as turnaround projects are usually short term, and if the project cannot ripen with a few years it is not undertaken.

More information is available in Chapter Four of Private Real Estate Investment and at mathestate.com.

R. J. Brown, Private Real Estate Investment: Data Analysis and Decision Making, Burlington, MA: Elsevier Academic Press, 2005.

Permanent Citation

"Value Added Growth Model"

http://demonstrations.wolfram.com/ValueAddedGrowthModel/

Wolfram Demonstrations Project

Published: March 7 2011